Embarking on the journey of understanding Why Wealth Planning Services Are Critical for Asset Protection, this introduction sets the stage for a comprehensive exploration of the topic, shedding light on the importance of safeguarding assets for long-term financial stability.

Delving deeper into the intricacies of wealth planning and asset protection, this opening paragraph aims to provide a solid foundation for the discussion ahead.

Importance of Asset Protection

Protecting assets is crucial for financial security as it helps individuals safeguard their hard-earned wealth from unexpected events or liabilities that could potentially deplete their resources.

Risks of Inadequate Asset Protection

Without adequate asset protection, individuals are vulnerable to various risks that can jeopardize their financial well-being.

- Legal liabilities: In the absence of proper asset protection, individuals may be at risk of losing their assets in lawsuits or legal disputes.

- Creditors' claims: Unprotected assets can be seized by creditors to satisfy outstanding debts, leading to significant financial losses.

- Divorce or family disputes: Lack of asset protection can result in assets being divided or lost in divorce settlements or family disputes.

Examples of Impactful Asset Protection

Asset protection strategies can make a significant difference in various situations:

- Business ownership: Implementing asset protection measures can shield personal assets from business-related risks, such as lawsuits or bankruptcy.

- Estate planning: Proper asset protection can ensure that assets are preserved for future generations and protected from probate or estate taxes.

- High-risk professions: Professionals in high-liability fields, such as doctors or attorneys, can benefit greatly from asset protection to safeguard their wealth from malpractice claims or lawsuits.

Role of Wealth Planning Services

Wealth planning services play a crucial role in helping individuals and businesses safeguard their assets and plan for the future. These services encompass a range of financial strategies and solutions tailored to meet the specific needs and goals of clients.

Comprehensive Financial Analysis

Wealth planning services typically begin with a comprehensive financial analysis to assess the current financial situation of the client. This analysis helps identify potential risks and vulnerabilities that could threaten the client's assets. By understanding the client's financial landscape, wealth planners can develop customized strategies to protect and grow their wealth.

Asset Protection Strategies

One of the key functions of wealth planning services is to implement asset protection strategies to shield assets from potential risks such as lawsuits, creditors, or unforeseen financial crises. Wealth planners utilize legal structures such as trusts, insurance policies, and investment vehicles to safeguard assets and minimize exposure to risks.

Tax Planning and Optimization

Wealth planning services also involve tax planning and optimization to help clients minimize their tax liabilities and maximize their wealth accumulation. By strategically managing taxes through deductions, credits, and other tax-efficient strategies, wealth planners can help clients retain more of their hard-earned assets.

Estate Planning

Estate planning is another crucial aspect of wealth planning services, ensuring that clients can pass on their assets to future generations in a tax-efficient and orderly manner. Wealth planners assist clients in creating wills, trusts, and other estate planning tools to preserve wealth and protect assets for their heirs.

Professional Advice and Guidance

Seeking professional wealth planning advice offers numerous benefits, including access to expertise and knowledge in financial planning, tax laws, and investment strategies. Wealth planners provide personalized guidance and recommendations based on the client's unique financial goals and objectives, helping them make informed decisions to secure their financial future.

Strategies for Asset Protection

When it comes to protecting your assets, there are various strategies that can be employed through wealth planning services to safeguard your financial well-being. These strategies are designed to minimize risks and preserve your wealth for the long term.

Asset Allocation

Asset allocation is a key strategy used in wealth planning for asset protection. By diversifying your investments across different asset classes, such as stocks, bonds, real estate, and commodities, you can reduce the impact of market fluctuations on your overall portfolio.

This ensures that you do not have all your eggs in one basket and helps to spread risk effectively.

Trusts

Establishing trusts is another common asset protection technique utilized in wealth planning. Trusts allow you to transfer assets to a trustee who manages them on behalf of your beneficiaries. This can help shield your assets from creditors and lawsuits, providing a layer of protection for your wealth.

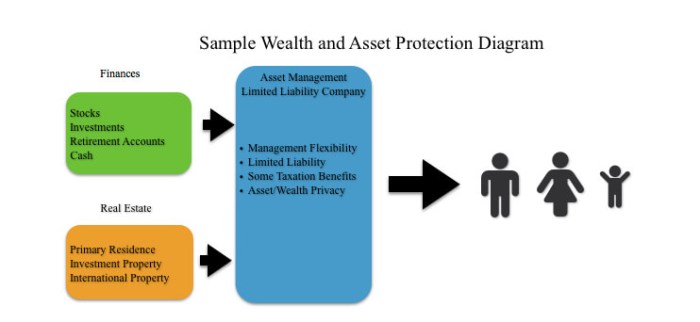

Limited Liability Companies (LLCs)

Creating LLCs is a popular strategy for protecting assets, especially for business owners. By forming an LLC, you can separate your personal assets from your business assets, limiting your liability in case of legal claims or debts related to the business.

This structure can help safeguard your personal wealth from being affected by business-related issues.

Insurance Policies

Having comprehensive insurance coverage is crucial for asset protection. Insurance policies, such as liability insurance, life insurance, and umbrella policies, can provide financial protection against unforeseen events like accidents, lawsuits, or natural disasters. By having the right insurance in place, you can mitigate potential risks to your assets.

Estate Planning

Estate planning plays a vital role in asset protection by ensuring that your assets are distributed according to your wishes and in a tax-efficient manner. By creating a detailed estate plan that includes wills, trusts, and powers of attorney, you can protect your assets for future generations and minimize estate taxes.

Real-Life Example

An individual who owns multiple rental properties decides to establish LLCs for each property to protect their personal assets from potential lawsuits related to the rental business. By structuring their investments in this way, they create a legal barrier between their personal wealth and business liabilities, safeguarding their financial well-being.

Legal Aspects of Wealth Planning

When it comes to wealth planning and asset protection, understanding the legal frameworks is crucial. Compliance with laws and regulations plays a significant role in the success of wealth planning strategies and ensuring the protection of assets.

Importance of Compliance in Wealth Planning

Compliance with legal requirements is essential in wealth planning to avoid any legal issues or challenges in the future. By adhering to laws and regulations, individuals can protect their assets and investments effectively.

Impact of Legal Considerations on Asset Protection Strategies

Legal considerations have a direct impact on asset protection strategies. For example, setting up trusts or establishing a legal entity for asset holding can provide additional layers of protection against potential creditors or legal claims. Understanding the legal implications of different wealth planning strategies is key to safeguarding assets.

Final Thoughts

Bringing our discussion to a close, it is evident that Why Wealth Planning Services Are Critical for Asset Protection plays a pivotal role in securing one's financial future. By implementing the right strategies and seeking professional advice, individuals can safeguard their assets and ensure a prosperous tomorrow.

Questions and Answers

What is the primary goal of asset protection?

The primary goal of asset protection is to safeguard assets from potential risks and threats, ensuring long-term financial security.

How can wealth planning services help in asset protection?

Wealth planning services can help in asset protection by designing tailored strategies to minimize risks, maximize wealth growth, and ensure proper distribution of assets.

Why is compliance with legal frameworks important in wealth planning?

Compliance with legal frameworks is crucial in wealth planning to avoid legal issues, protect assets effectively, and maintain financial stability in the long run.