Delving into the realm of Private Wealth Management Strategies Used by Global Investors, readers are invited to explore a world where financial prowess meets strategic decision-making. This introductory passage sets the stage for a deep dive into the intricacies of managing wealth on a global scale.

Private wealth management involves the strategic management of assets to achieve financial goals. It is crucial for global investors seeking to optimize their wealth accumulation and preservation strategies. As we delve into the key strategies and trends in this field, a captivating journey unfolds.

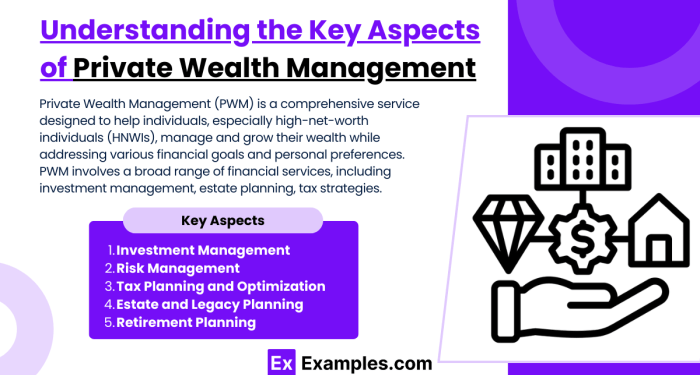

Private Wealth Management Overview

Private wealth management refers to the specialized financial services provided to high net worth individuals, families, and organizations. It involves the creation of a tailored investment strategy to manage and grow their wealth effectively.

Importance of Private Wealth Management for Global Investors

Private wealth management is crucial for global investors as it helps them preserve and increase their wealth over time. By working with wealth managers, investors can benefit from personalized strategies that consider their financial goals, risk tolerance, and unique circumstances.

This customized approach can lead to optimized investment decisions and asset allocation, ultimately maximizing returns while minimizing risks.

Examples of Assets Typically Managed in Private Wealth Management

- Equities: Stocks of publicly traded companies

- Bonds: Fixed-income securities issued by governments or corporations

- Real Estate: Properties and real estate investment trusts (REITs)

- Alternative Investments: Hedge funds, private equity, and venture capital

- Commodities: Precious metals, energy products, and agricultural goods

Key Strategies in Private Wealth Management

Private wealth management involves a variety of strategies utilized by global investors to maximize their wealth and achieve their financial goals. Diversification, risk management, and strategic asset allocation are key components of successful private wealth management strategies.

Diversification Benefits

Diversification is a fundamental strategy in private wealth management that involves spreading investments across different asset classes, industries, and geographic regions. By diversifying their portfolios, investors can reduce the overall risk of their investments. This is because different asset classes tend to perform differently under various market conditions.

For example, during times of economic downturn, stocks may decline while bonds remain stable. By diversifying, investors can mitigate the impact of market volatility on their overall wealth.

Risk Management in Private Wealth Management

Risk management is another crucial strategy in private wealth management that involves identifying, assessing, and managing risks associated with investments. Investors need to carefully evaluate the risk-return tradeoff of each investment opportunity and make informed decisions based on their risk tolerance and financial goals.

Utilizing tools like stop-loss orders, hedging strategies, and diversification can help investors minimize potential losses and preserve their wealth over the long term.

Global Investment Trends in Private Wealth Management

In today's rapidly evolving global investment landscape, private wealth management has seen significant shifts in trends and strategies. Let's delve into the current trends shaping the world of private wealth management and how they impact investment decisions.

Traditional vs Modern Investment Approaches

In the past, traditional investment approaches in private wealth management often focused on long-term strategies, such as investing in stocks, bonds, and real estate. These strategies were characterized by a conservative approach aimed at preserving wealth over time. However, modern investment approaches have witnessed a shift towards more diversified portfolios, including alternative investments like private equity, hedge funds, and venture capital.

This shift is driven by the need for higher returns in a low-interest rate environment and the desire to mitigate risks through diversification.

Geopolitical Factors Impacting Wealth Management Decisions

Geopolitical factors, such as trade tensions, political instability, and global economic trends, play a crucial role in shaping private wealth management decisions. Investors must navigate these complex dynamics to protect and grow their wealth effectively. For instance, geopolitical events like Brexit or the U.S.-China trade war can impact asset prices, currency values, and market volatility, influencing investment strategies.

As a result, wealth managers need to stay informed about global developments and adapt their strategies accordingly to mitigate risks and capitalize on opportunities.

Technology and Innovation in Private Wealth Management

Technology plays a crucial role in transforming the landscape of private wealth management practices. With the rapid advancements in digital tools and platforms, global investors are leveraging technology to enhance their strategies and create more efficient processes.

Impact of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are revolutionizing private wealth management strategies by enabling data-driven decision-making and personalized recommendations. These technologies analyze vast amounts of financial data in real-time, helping investors identify trends, manage risks, and optimize their portfolios effectively.

Innovative Tools Used by Global Investors

Global investors are utilizing a variety of innovative tools to streamline their wealth management processes. Robo-advisors, for example, use algorithms to provide automated investment advice based on individual goals and risk tolerance. Additionally, blockchain technology is being explored for its potential to enhance security and transparency in wealth management transactions.

Summary

In conclusion, Private Wealth Management Strategies Used by Global Investors offer a window into the dynamic landscape of financial decision-making. By understanding the nuances of diversification, risk management, and technological innovations, investors can navigate the complexities of wealth management with confidence and foresight.

FAQ Section

What is the role of risk management in private wealth management?

Risk management in private wealth management involves identifying, assessing, and mitigating potential risks to protect and grow assets effectively.

How do geopolitical factors impact private wealth management decisions?

Geopolitical factors such as trade policies, economic stability, and regulatory changes can influence investment strategies and asset allocation decisions in private wealth management.