Exploring the nexus between wealth planning services and lifestyle goals, this piece delves into the intricate ways financial strategies can be tailored to meet individual aspirations. Let's embark on a journey of financial empowerment and lifestyle alignment.

Delve into the realm of personalized wealth planning and its impact on shaping a fulfilling lifestyle for the future.

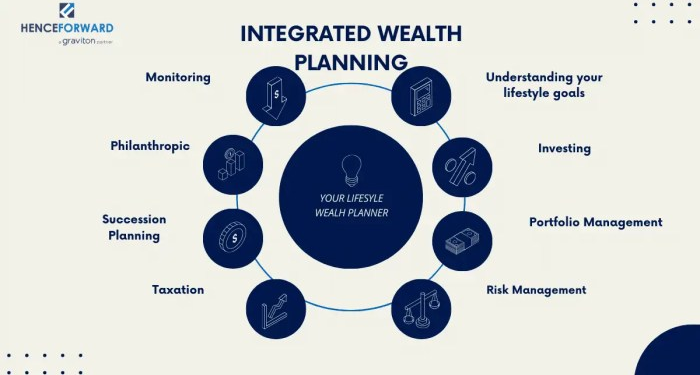

How Wealth Planning Services Work

Wealth planning services play a crucial role in aligning financial goals with lifestyle by creating personalized strategies to help individuals achieve their aspirations. These services focus on understanding the client's objectives, risk tolerance, and current financial situation to develop a comprehensive plan tailored to their unique needs.

Financial Strategies Used by Wealth Planners

- Asset Allocation: Wealth planners help clients diversify their investments across various asset classes to manage risk and optimize returns.

- Estate Planning: Wealth planners assist in structuring an estate plan to ensure the efficient transfer of wealth to future generations or charitable causes.

- Tax Planning: Wealth planners employ strategies to minimize tax liabilities and maximize after-tax returns for clients.

- Retirement Planning: Wealth planners develop retirement savings strategies to help clients maintain their desired lifestyle after they stop working.

Importance of Customized Wealth Plans

Creating a customized wealth plan based on individual goals and aspirations is essential to ensure that the financial strategy aligns with the client's lifestyle objectives. A one-size-fits-all approach may not be suitable for everyone, as each individual has unique financial goals and circumstances that require personalized attention.

Understanding Financial Goals

When it comes to wealth planning services, understanding a client's financial goals is crucial. This process involves identifying and prioritizing what the client wants to achieve financially, both in the short term and long term. By aligning these goals with their lifestyle aspirations, wealth planners can create a personalized financial roadmap for their clients.

Identifying and Prioritizing Financial Goals

- Start by having detailed discussions with the client to understand their financial aspirations, such as buying a home, saving for retirement, funding their children's education, or starting a business.

- Help the client prioritize these goals based on their importance and urgency, considering factors like timeline, financial resources, and risk tolerance.

- Work together to set specific, measurable, achievable, relevant, and time-bound (SMART) goals that form the basis of the financial plan.

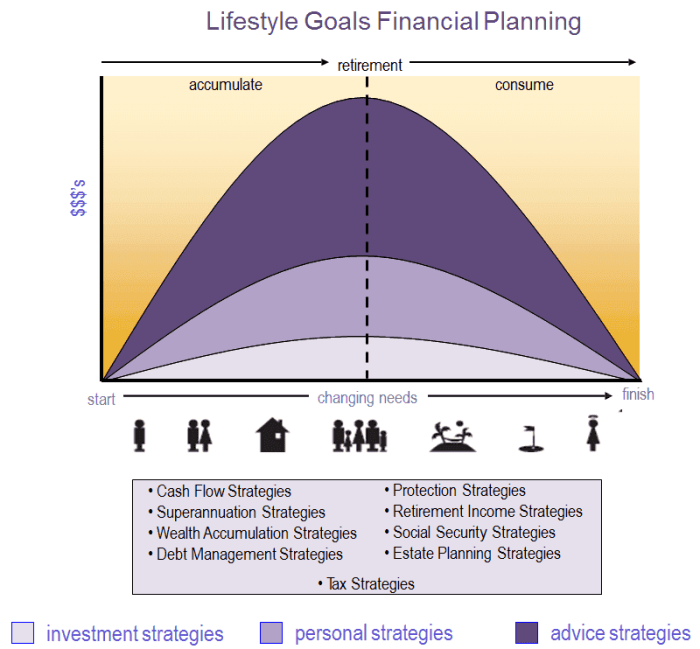

Short-term vs. Long-term Financial Goals

- Short-term goals typically involve immediate financial needs or desires, such as building an emergency fund, paying off debt, or taking a vacation.

- Long-term goals focus on achievements that may take years to reach, like buying a second home, retiring comfortably, or leaving a legacy for future generations.

- Both types of goals impact lifestyle planning, as short-term goals can provide immediate gratification while long-term goals require patience and discipline.

Assessing Risk Tolerance and Investment Preferences

- Wealth planners evaluate clients' risk tolerance by considering factors like their age, financial situation, investment knowledge, and comfort level with market fluctuations.

- Understanding clients' investment preferences helps wealth planners recommend suitable investment options that align with their goals, whether they prefer conservative, moderate, or aggressive strategies.

- By considering these factors, wealth planners can tailor the financial plan to meet the client's objectives while managing risks effectively.

Lifestyle Analysis

Understanding the lifestyle of clients is a crucial aspect of wealth planning services as it helps financial advisors create a personalized wealth plan that aligns with their financial goals and aspirations.

Tools and Techniques for Lifestyle Analysis

- Financial Questionnaires: Advisors use detailed questionnaires to gather information about clients' income, expenses, assets, and liabilities.

- Expense Tracking Tools: Utilizing software or apps to track spending habits and identify areas for potential savings or adjustments.

- Goal Setting Sessions: Discussing clients' short-term and long-term goals to understand their lifestyle aspirations and financial needs.

Benefits of Lifestyle Analysis in Wealth Planning

- Customized Wealth Plan: By analyzing clients' lifestyle, advisors can tailor a wealth plan that reflects their unique preferences and priorities.

- Risk Assessment: Understanding clients' spending habits allows advisors to assess potential risks and create strategies to mitigate them.

- Adjustments and Recommendations: Lifestyle analysis helps in making necessary adjustments and recommendations to ensure financial stability and growth.

Financial Strategies Alignment

When it comes to wealth planning services, aligning financial strategies with clients' lifestyle goals is crucial for long-term success. By understanding the unique objectives and preferences of each client, financial advisors can develop tailored strategies that help individuals achieve their desired lifestyle.

Successful Case Studies

- One successful financial strategy involved creating a diversified investment portfolio for a client looking to retire early and travel extensively. By balancing risk and return, the client was able to grow their wealth steadily while funding their travel goals.

- Another example is a client who wanted to purchase a second home for vacation purposes. Through careful budgeting and savings strategies, the client was able to afford the property without compromising their long-term financial security.

Ongoing Monitoring and Adjustments

It's essential for financial strategies to evolve with changing lifestyle goals. Regular monitoring allows advisors to assess the effectiveness of the current plan and make necessary adjustments to stay aligned with the client's objectives. Whether it's a career change, a new family member, or shifting priorities, ongoing monitoring ensures that financial strategies remain flexible and adaptable.

Ultimate Conclusion

In conclusion, the seamless integration of wealth planning services with lifestyle objectives underscores the importance of strategic financial alignment. As we navigate the complexities of financial goal-setting, remember that a well-crafted wealth plan can pave the way for a future of abundance and security.

Clarifying Questions

How can wealth planning services help align financial goals with lifestyle aspirations?

Wealth planning services utilize personalized strategies to tailor financial plans according to individual goals, ensuring a harmonious alignment with lifestyle aspirations.

What factors are considered when identifying and prioritizing financial goals for clients?

Factors such as risk tolerance, investment preferences, and short-term versus long-term goals play a crucial role in the process of identifying and prioritizing financial objectives.

Why is lifestyle analysis important in wealth planning?

Conducting a lifestyle analysis helps wealth planners understand clients' spending habits, financial needs, and future aspirations, forming the foundation for a comprehensive wealth plan.

How do wealth planning services ensure ongoing alignment of financial strategies with changing lifestyle goals?

Through regular monitoring and adjustments, wealth planning services adapt financial strategies to evolving lifestyle goals, ensuring continued alignment and success.