Exploring the realm of Wealth Management Advisor Near Me: What Services Are Included, this introduction aims to captivate readers with a compelling narrative, presenting a blend of information and intrigue right from the start.

The subsequent paragraph will delve into the specifics of the topic, offering clarity and insight.

Wealth Management Advisor Near Me

When seeking a wealth management advisor near you, it's essential to understand the role they play in helping individuals and families secure their financial future. These professionals offer a range of services tailored to meet the unique needs and goals of their clients.

Role of a Wealth Management Advisor

A wealth management advisor serves as a financial coach, guiding clients in making informed decisions to grow and protect their wealth. They provide personalized advice and strategies to help individuals navigate complex financial landscapes.

Services Offered by Wealth Management Advisors

- Investment Management: Creating and managing investment portfolios based on risk tolerance and financial goals.

- Retirement Planning: Developing strategies to ensure a comfortable retirement through savings, investments, and pension plans.

- Estate Planning: Helping clients protect their assets and ensure a smooth transfer of wealth to future generations.

- Tax Planning: Minimizing tax liabilities through strategic planning and investment choices.

Importance of Personalized Financial Planning

Personalized financial planning is crucial as it takes into account individual goals, risk tolerance, and financial circumstances. Wealth management advisors tailor their recommendations to each client's specific needs, ensuring a more effective and successful financial plan.

How Wealth Management Advisors Help Clients Achieve Financial Goals

Wealth management advisors work closely with clients to understand their objectives and develop a comprehensive financial roadmap. By providing ongoing guidance, monitoring progress, and adapting strategies as needed, these professionals help clients stay on track to achieve their financial goals.

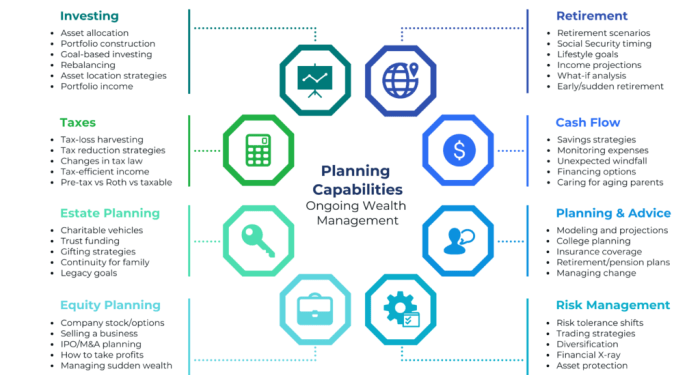

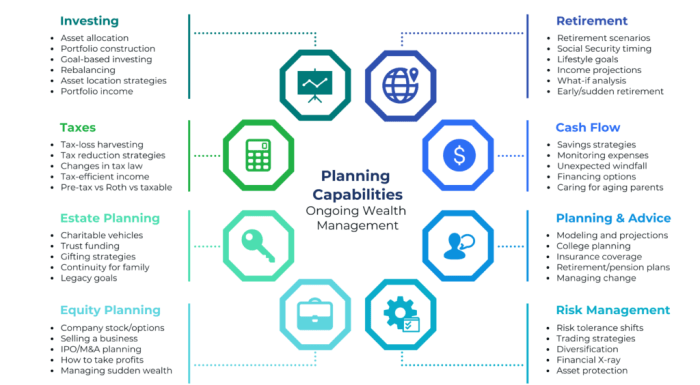

Financial Planning Services

When it comes to financial planning services offered by wealth management advisors, there are several key areas that they focus on to help clients achieve their financial goals. These services include investment planning, retirement planning, estate planning, tax planning, and risk management.

Each of these areas plays a crucial role in creating a comprehensive financial plan tailored to meet the individual needs of the client.

Investment Planning

Investment planning is a fundamental aspect of financial planning that involves creating a strategy to help clients grow their wealth over time. Wealth management advisors work with clients to identify their financial goals, risk tolerance, and investment preferences to develop a diversified investment portfolio that aligns with their objectives.

Retirement Planning

Retirement planning focuses on helping clients prepare financially for their retirement years. Wealth management advisors assess the client's current financial situation, projected retirement expenses, and income sources to create a plan that ensures a comfortable retirement lifestyle. This may involve setting up retirement accounts, optimizing Social Security benefits, and creating a withdrawal strategy.

Estate Planning

Estate planning involves creating a plan for the distribution of assets after the client's passing. Wealth management advisors help clients minimize estate taxes, designate beneficiaries, establish trusts, and create a will to ensure that their assets are passed on according to their wishes.

Tax Planning and Risk Management

Tax planning is an essential component of financial planning that aims to minimize tax liabilities and maximize tax efficiency. Wealth management advisors help clients navigate complex tax laws, identify tax-saving opportunities, and optimize their tax strategies. Risk management involves assessing and mitigating financial risks to protect the client's assets and achieve long-term financial security

By providing personalized guidance and expertise, wealth management advisors help clients navigate the complexities of financial planning and achieve their desired financial outcomes.

Investment Management

When it comes to investment management, wealth management advisors play a crucial role in helping clients make informed decisions to grow their wealth effectively. They analyze the client's financial situation, goals, and risk tolerance to develop a personalized investment strategy.

Creating an Investment Portfolio

Wealth management advisors work closely with clients to create a diversified investment portfolio tailored to their specific goals and risk tolerance. This involves selecting a mix of assets such as stocks, bonds, real estate, and alternative investments to optimize returns while managing risk.

- Asset Allocation: Advisors determine the ideal mix of assets based on the client's goals, time horizon, and risk tolerance.

- Diversification: By spreading investments across different asset classes, advisors help reduce risk and minimize the impact of market fluctuations.

- Risk Management: Advisors continuously monitor the portfolio to ensure it aligns with the client's risk profile and make adjustments as needed.

Monitoring and Adjusting Portfolios

Wealth management advisors regularly review and rebalance investment portfolios to ensure they remain aligned with the client's financial goals and risk tolerance. They stay up-to-date on market trends, economic conditions, and changes in the client's circumstances to make informed decisions about portfolio adjustments.

- Performance Tracking: Advisors track the performance of investments and compare them against benchmarks to evaluate their effectiveness.

- Rebalancing: If the portfolio drifts from its target allocation, advisors rebalance it by buying or selling assets to realign with the client's investment strategy.

- Financial Planning: Advisors integrate investment management into the overall financial plan, considering tax implications, retirement goals, and estate planning.

Wealth Preservation and Risk Management

When it comes to wealth preservation and risk management, wealth management advisors offer a range of services to help clients protect and grow their assets over time. These services are crucial in ensuring financial stability and security for the future.

Insurance Planning and Emergency Fund Management

- One key aspect of wealth preservation is insurance planning, which involves assessing the client's insurance needs and recommending appropriate coverage to protect against unforeseen events such as accidents, illnesses, or natural disasters.

- Emergency fund management is another important strategy for mitigating financial risks. Wealth management advisors help clients establish and maintain emergency funds to cover unexpected expenses and financial setbacks, ensuring that their long-term financial goals are not derailed by unforeseen circumstances.

- For example, in the event of a medical emergency or job loss, having an adequate emergency fund in place can provide a financial safety net and prevent clients from having to dip into their investments or savings prematurely.

Concluding Remarks

Concluding our discussion, the outro will provide a concise summary of the key points discussed, leaving readers with a lasting impression.

Clarifying Questions

What is the role of a wealth management advisor?

A wealth management advisor assists clients in managing and growing their wealth through personalized financial planning and investment strategies.

How do wealth management advisors help clients achieve their financial goals?

Wealth management advisors work closely with clients to develop tailored financial plans that align with their objectives and risk tolerance, guiding them towards their desired financial outcomes.

Why is tax planning significant in financial planning?

Tax planning is crucial as it helps clients optimize their tax liabilities and maximize their savings, ensuring a more efficient financial strategy overall.

How do wealth management advisors tailor financial plans to individual client needs?

Wealth management advisors customize financial plans by considering clients' unique financial circumstances, goals, and risk profiles, creating a personalized approach to wealth management.