Exploring the world of high net worth advisors and their strategies in building diversified investment portfolios sets the stage for a compelling journey through the realm of wealth management.

Delving deeper into the principles of diversification, risk assessment, and asset allocation, this topic unveils the intricate processes behind successful portfolio management for high net worth individuals.

Understanding High Net Worth Advisors

High net worth advisors play a crucial role in managing the wealth of individuals with substantial assets. These advisors provide personalized financial advice and investment strategies to help their clients grow, preserve, and transfer their wealth effectively.Specialized expertise is essential when advising high net worth clients due to the complexity of their financial situations.

High net worth individuals often have diverse investment portfolios, multiple income streams, and intricate estate planning needs. Advisors with specialized knowledge in areas such as tax planning, estate planning, risk management, and investment management can offer tailored solutions to meet the unique needs of high net worth clients.

Typical Client Profile

High net worth advisors typically work with clients who have investable assets ranging from $1 million to several million dollars. These clients may include business owners, executives, entrepreneurs, inheritors, and professionals in high-paying industries. High net worth individuals often require sophisticated financial strategies to optimize their wealth accumulation, protection, and distribution over time.

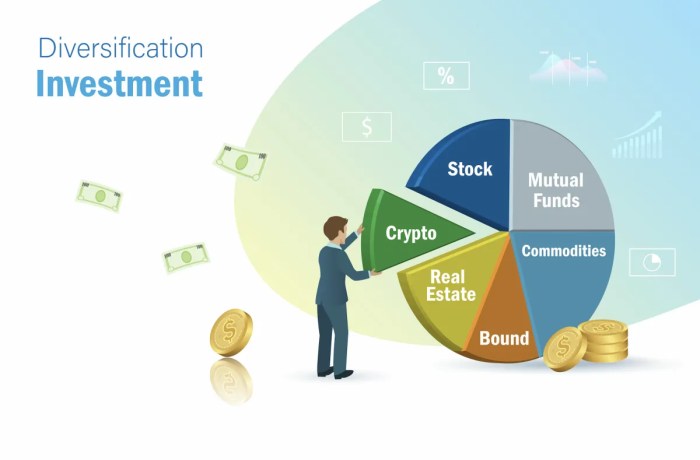

Principles of Diversification in Investment Portfolios

Diversification is a strategy used by investors to spread their investments across different asset classes to reduce risk. By diversifying, investors aim to minimize the impact of any single investment performing poorly on the overall portfolio.

Importance of Diversification

Diversification is crucial for high net worth individuals as it helps in managing risk and volatility in their investment portfolios. By spreading investments across various asset classes, such as stocks, bonds, real estate, and commodities, high net worth individuals can potentially achieve more stable returns over the long term.

- Diversification helps in reducing the overall risk of the portfolio by not being overly reliant on a single asset class.

- It allows investors to capture the performance of different sectors of the economy, thus reducing the impact of economic downturns on their portfolio.

- By diversifying geographically, investors can also mitigate risks associated with specific regions or countries experiencing economic or political challenges.

Asset Classes in a Diversified Portfolio

When building a diversified investment portfolio, high net worth advisors often include a mix of the following asset classes:

- Stocks:Equities of publicly traded companies that offer the potential for capital appreciation.

- Bonds:Fixed-income securities issued by governments or corporations, providing regular interest payments.

- Real Estate:Investments in physical properties or real estate investment trusts (REITs) for income generation and potential appreciation.

- Commodities:Raw materials such as gold, silver, oil, or agricultural products that can act as a hedge against inflation.

- Alternative Investments:Including hedge funds, private equity, or venture capital for diversification beyond traditional asset classes.

Strategies for Building Diversified Investment Portfolios

When it comes to building diversified investment portfolios for high net worth individuals, advisors employ various strategies to optimize returns while managing risks effectively.

Assessing Risk Tolerance

High net worth advisors start by assessing the risk tolerance of their clients

Role of Asset Allocation

Asset allocation plays a crucial role in creating diversified investment portfolios. By spreading investments across different asset classes such as stocks, bonds, real estate, and commodities, advisors can reduce the overall risk exposure of the portfolio. A well-thought-out asset allocation strategy helps in achieving the desired risk-return balance based on the client's financial goals and time horizon.

Techniques for Selecting Investment Vehicles

When it comes to selecting appropriate investment vehicles for diversification, high net worth advisors consider various factors such as liquidity, volatility, correlation with other assets, and tax implications. They may opt for a mix of mutual funds, exchange-traded funds (ETFs), individual stocks, bonds, and alternative investments to achieve diversification.

Additionally, they may also look into strategies like dollar-cost averaging, rebalancing, and tax-loss harvesting to enhance portfolio diversification and performance.

Incorporating Alternative Investments in Portfolios

Alternative investments play a crucial role in diversifying high net worth clients' portfolios beyond traditional assets like stocks and bonds. These investments can help reduce overall portfolio risk and enhance potential returns by providing exposure to different markets and strategies.

Benefits and Risks of Alternative Investments

- Benefits:

- Diversification: Alternative investments have low correlation with traditional assets, reducing overall portfolio risk.

- Potential for higher returns: Some alternative investments offer the potential for significant gains compared to traditional assets.

- Hedging against market volatility: Alternative investments can provide a hedge against market downturns and economic uncertainties.

- Risks:

- Illiquidity: Many alternative investments have lock-up periods, making it difficult to access funds quickly.

- Complexity: Alternative investments often require a high level of expertise to evaluate and manage effectively.

- Higher fees: Alternative investments typically come with higher fees compared to traditional assets.

Examples of Alternative Investment Options

| Alternative Investment | Description |

|---|---|

| Private Equity | Investing in privately-held companies with the potential for high returns upon exit. |

| Real Estate Investment Trusts (REITs) | Investing in real estate properties through publicly traded companies or funds. |

| Hedge Funds | Funds that employ various strategies to generate returns, often with higher risk and higher returns potential. |

| Commodities | Investing in physical goods such as gold, oil, or agricultural products as a hedge against inflation. |

Last Recap

In conclusion, the art of building diversified investment portfolios as mastered by high net worth advisors is a blend of expertise, strategy, and innovation. This discussion sheds light on the key elements that drive wealth creation and preservation in the dynamic world of investments.

Question & Answer Hub

What criteria do high net worth advisors consider when assessing risk tolerance?

High net worth advisors take into account factors such as investment goals, time horizon, and personal risk preferences when evaluating risk tolerance for clients.

Why are alternative investments important for diversifying portfolios of high net worth clients?

Alternative investments provide unique opportunities to diversify beyond traditional asset classes, potentially enhancing portfolio returns and reducing overall risk.