Exploring the advantages of Multi Family Office Services for Ultra High Net Worth Families sets the stage for a deep dive into the world of tailored financial management. As we delve into the intricacies of these specialized services, a wealth of benefits and strategies await discovery.

The following paragraphs will shed light on the unique ways in which Multi Family Office Services cater to the distinctive needs of Ultra High Net Worth Families, offering a personalized approach to wealth preservation and growth.

Overview of Multi Family Office Services

Multi family office services refer to comprehensive wealth management services provided to ultra high net worth families. These services are tailored to meet the unique needs and goals of wealthy families and typically involve a wide range of financial and advisory services.

Primary Functions and Objectives of Multi Family Offices

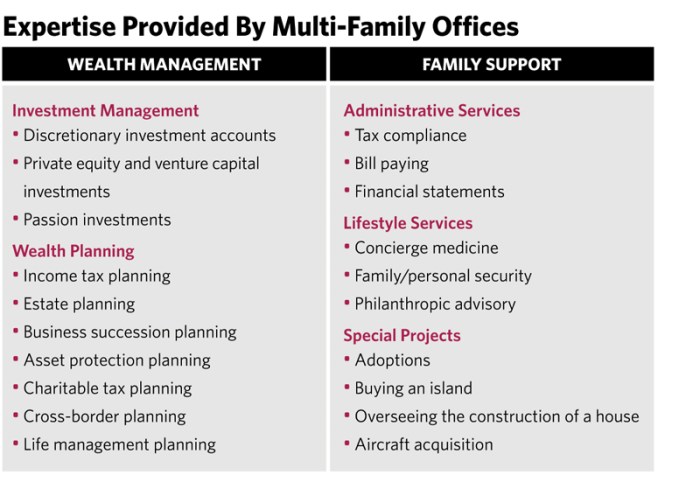

Multi family offices aim to preserve and grow the wealth of ultra high net worth families across generations. They provide a holistic approach to wealth management, offering services such as investment management, financial planning, tax planning, estate planning, philanthropic planning, and more.

By integrating these services, multi family offices help families achieve their financial objectives while navigating complex financial landscapes.

Key Services Offered by Multi Family Offices

- Investment Management: Multi family offices provide customized investment strategies and portfolio management to help families achieve their financial goals.

- Financial Planning: They offer comprehensive financial planning services to align the family's financial resources with their long-term objectives.

- Tax Planning: Multi family offices help families optimize their tax strategies to minimize tax liabilities and maximize wealth preservation.

- Estate Planning: They assist families in creating and implementing estate plans to ensure smooth wealth transfer and minimize estate tax implications.

- Philanthropic Planning: Multi family offices help families establish and manage charitable foundations or trusts to support their philanthropic endeavors.

Importance of Multi Family Offices for Ultra High Net Worth Families

Ultra high net worth families have complex financial needs that require specialized attention and expertise. Multi family offices play a crucial role in meeting these needs by offering tailored services that go beyond traditional wealth management firms.

Unique Needs of Ultra High Net Worth Families Addressed by Multi Family Offices

Multi family offices are equipped to handle the intricate financial situations of ultra high net worth families. They provide comprehensive services that cater to the following unique needs:

- Family Governance and Education: Multi family offices assist in establishing family governance structures and educate family members on financial matters to ensure wealth preservation and continuity across generations.

- Estate Planning and Philanthropy: These offices help ultra high net worth families create strategic estate plans and charitable giving strategies to align with their values and goals.

- Concierge Services: Multi family offices offer concierge services such as bill payment, travel arrangements, and lifestyle management to simplify the daily lives of ultra high net worth individuals.

- Alternative Investments: They provide access to exclusive alternative investment opportunities, including private equity, hedge funds, and real estate, to diversify and grow family wealth.

Comparison of Services Offered by Multi Family Offices to Traditional Wealth Management Firms

While traditional wealth management firms focus on investment management and financial planning, multi family offices go above and beyond by offering a holistic approach to wealth management. They provide a higher level of customization, personalization, and integration of services to meet the complex needs of ultra high net worth families.

Customization and Personalization of Services

Multi family offices go above and beyond to tailor their services to meet the specific needs of ultra high net worth families, providing a highly personalized experience.

Examples of Customized Services

- Customized Investment Portfolios: Multi family offices design investment portfolios based on the unique risk tolerance, financial goals, and preferences of each ultra high net worth family.

- Estate Planning Solutions: Tailored estate planning services that take into account the complex family structures and individual objectives of the family members.

- Concierge Services: Personalized concierge services such as travel planning, philanthropic initiatives, and lifestyle management to cater to the specific needs and preferences of the family.

Importance of Personalized Financial Planning

Personalized financial planning is crucial for ultra high net worth families as it ensures that their unique financial goals, risk tolerance, and family dynamics are all taken into consideration. This level of customization helps in maximizing wealth preservation, minimizing tax liabilities, and achieving long-term financial objectives effectively.

Wealth Management and Investment Strategies

When it comes to ultra high net worth families, wealth management and investment strategies play a crucial role in preserving and growing their assets. Multi family offices are well-equipped to handle the complex financial needs of these families, offering tailored solutions to help them achieve their financial goals.

Wealth Management Strategies

Wealth management strategies employed by multi family offices for ultra high net worth families are comprehensive and customized. They involve a holistic approach that takes into account the family's financial goals, risk tolerance, and time horizon. These strategies often include tax planning, estate planning, philanthropic initiatives, and asset protection.

- Utilization of trusts, foundations, and other legal structures to optimize tax efficiency.

- Regular review and adjustment of investment portfolios to align with changing market conditions and client objectives.

- Integration of financial planning services to ensure all aspects of the client's financial life are coordinated and optimized.

Investment Approaches and Portfolio Management

Multi family offices employ sophisticated investment approaches and portfolio management techniques to help ultra high net worth families achieve long-term financial success. These strategies are designed to generate returns while managing risk effectively.

- Asset allocation strategies based on the client's risk profile and investment objectives.

- Active management of investment portfolios to capitalize on opportunities and mitigate risks.

- Use of alternative investments such as private equity, hedge funds, and real estate to diversify and enhance returns.

Role of Risk Management and Diversification

Risk management and diversification are fundamental principles in wealth preservation for ultra high net worth families. Multi family offices place a strong emphasis on these aspects to protect and grow the client's wealth over time.

- Implementation of risk management strategies to mitigate potential losses and protect against market volatility.

- Diversification of investment portfolios across different asset classes to reduce concentration risk.

- Regular stress testing and scenario analysis to assess the impact of various market conditions on the client's portfolio.

Estate Planning and Philanthropic Services

Estate planning and philanthropic services are crucial aspects of multi family office offerings for ultra high net worth families. These services go beyond traditional wealth management to ensure a smooth transfer of assets and support charitable giving initiatives.

Estate Planning Services

Multi family offices provide comprehensive estate planning services to help ultra high net worth families preserve and transfer their wealth efficiently. This includes creating wills, trusts, and other legal structures to minimize tax implications and ensure the intended beneficiaries receive their inheritance as planned.

By working closely with estate planning experts, multi family offices can tailor strategies to meet the unique needs of each family.

Philanthropic Endeavors

Multi family offices play a key role in assisting ultra high net worth families with their philanthropic endeavors. They help families establish charitable foundations, donor-advised funds, and other vehicles for giving back to society. By developing strategic philanthropic plans, multi family offices ensure that charitable donations have a lasting impact and align with the family's values and goals.

Successful Initiatives

One example of a successful estate planning initiative facilitated by a multi family office is the establishment of a dynasty trust to preserve wealth for future generations. This long-term strategy allows families to pass down assets while minimizing estate taxes and protecting assets from creditors.In terms of philanthropic initiatives, a multi family office may have helped a family set up a scholarship fund to support education in underprivileged communities.

By managing the fund and selecting deserving recipients, the family can make a meaningful contribution to society while leaving a lasting legacy.Overall, estate planning and philanthropic services offered by multi family offices are essential for ultra high net worth families looking to secure their legacy and make a positive impact on the world.

Family Governance and Education

Family governance plays a crucial role in multi family office services for ultra high net worth families. It helps establish guidelines and structures for decision-making, wealth preservation, and succession planning within the family.

Importance of Family Governance

Family governance ensures that the family's values, goals, and wealth management strategies are aligned across generations. It helps prevent conflicts, fosters unity, and promotes transparency and communication among family members.

- Establishing a family constitution outlining roles, responsibilities, and decision-making processes.

- Creating family councils or meetings to discuss financial matters, investments, and philanthropic initiatives.

- Setting up governance structures for family businesses, trusts, and charitable foundations.

Educating Family Members

Multi family offices educate family members on financial literacy and wealth management to ensure that they are well-equipped to handle the family's assets responsibly and sustainably.

- Providing financial education workshops, seminars, and resources tailored to different age groups and levels of understanding.

- Offering mentorship programs and individualized coaching to family members interested in learning more about investments, estate planning, and philanthropy.

- Encouraging open discussions about money, values, and goals to promote a shared understanding and vision for the family's future.

Fostering Communication and Unity

Effective communication and unity among family members are essential for successful wealth preservation and intergenerational transfer of assets. Multi family offices employ various strategies to foster a cohesive family dynamic.

- Facilitating family meetings and retreats to discuss financial matters, address concerns, and set common objectives.

- Encouraging active participation and engagement from all family members in decision-making processes and governance structures.

- Promoting a culture of respect, trust, and collaboration to strengthen family relationships and ensure a smooth transition of wealth across generations.

Last Recap

In conclusion, the realm of Multi Family Office Services proves to be a vital asset for Ultra High Net Worth Families, providing a comprehensive suite of services that go beyond traditional wealth management. With a focus on customization, education, and strategic planning, these services pave the way for sustainable financial success and legacy preservation.

User Queries

How do Multi Family Office Services differ from traditional wealth management firms for Ultra High Net Worth Families?

Multi Family Offices offer a more personalized and tailored approach to wealth management, catering specifically to the unique needs and goals of Ultra High Net Worth Families. They focus on holistic financial planning beyond just investments.

What role does risk management play in wealth preservation for Ultra High Net Worth Families with Multi Family Offices?

Risk management is crucial in ensuring the long-term sustainability of wealth for Ultra High Net Worth Families. Multi Family Offices employ sophisticated strategies to mitigate risks and diversify investments effectively.

How do Multi Family Offices assist with estate planning for Ultra High Net Worth Families?

Multi Family Offices provide comprehensive estate planning services that include structuring trusts, minimizing tax liabilities, and ensuring smooth wealth transfer to future generations.