Embark on a journey exploring how multi-family office services play a crucial role in supporting legacy and estate planning. Delve into the intricate world of financial management and wealth preservation with the expertise of multi-family offices.

Overview of Multi Family Office Services

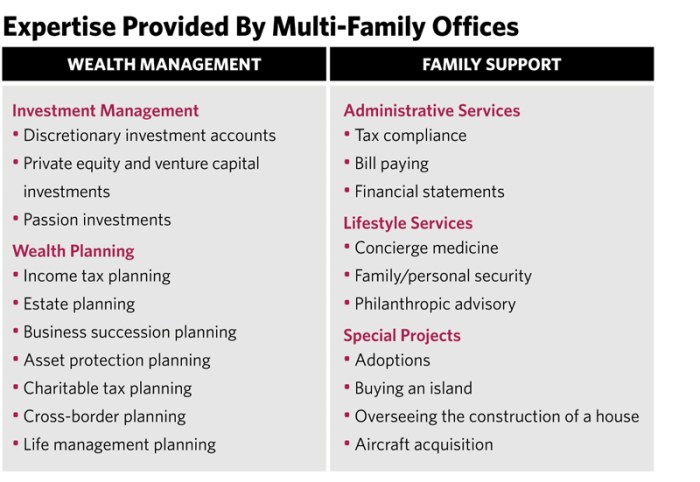

Multi-family office services are comprehensive financial services tailored to meet the specific needs of high-net-worth families. These services go beyond traditional wealth management to provide a holistic approach to financial planning and management.

Services Offered by Multi-Family Offices

- Investment Management: Multi-family offices help clients manage their investment portfolios, including asset allocation, risk management, and investment selection.

- Financial Planning: They assist in creating a financial plan that aligns with the family's long-term goals, including retirement planning, education funding, and estate planning.

- Tax Planning: Multi-family offices provide tax planning strategies to minimize tax liabilities and maximize tax efficiency for clients.

- Trust and Estate Administration: They offer services to manage trusts, estates, and other legal entities, ensuring a smooth transfer of wealth to future generations.

- Philanthropic Planning: Multi-family offices help clients develop charitable giving strategies and establish philanthropic initiatives.

Benefits of Utilizing a Multi-Family Office

- Personalized Service: Multi-family offices offer personalized financial services tailored to the unique needs and goals of each family.

- Expertise and Experience: Clients benefit from the expertise of professionals with a deep understanding of complex financial matters.

- Coordination of Services: Multi-family offices coordinate various aspects of financial planning, including investments, taxes, and estate planning, to provide a comprehensive approach.

- Legacy Planning: They assist in creating a legacy plan to preserve wealth for future generations and ensure a lasting impact on the family's legacy.

Importance of Legacy Planning

Legacy planning is a crucial component of wealth management that focuses on preserving and passing down assets, values, and beliefs to future generations. It goes beyond traditional estate planning by encompassing a broader scope of considerations to ensure a lasting impact and legacy for your family and community.

Key Aspects of Legacy Planning

Legacy planning involves not only the distribution of assets but also the transmission of values, stories, and family history. It includes identifying and documenting your goals, values, and wishes to guide future generations. Moreover, it emphasizes the importance of philanthropy, education, and stewardship to leave a positive impact on society.

Differences from Traditional Estate Planning

Legacy planning differs from traditional estate planning in its holistic approach to wealth transfer. While estate planning primarily focuses on the efficient distribution of assets and minimizing taxes, legacy planning considers the emotional and intangible aspects of wealth. It prioritizes preserving family values, fostering communication among family members, and creating a lasting legacy beyond financial wealth.

Role of Multi Family Offices in Legacy Planning

Multi-family offices play a crucial role in helping clients create and implement effective legacy plans to preserve and transfer wealth across generations. These specialized firms offer personalized services tailored to the unique needs and goals of each family.

Strategies Used by Multi-Family Offices

- Asset Protection: Multi-family offices help families protect their assets from potential risks, such as lawsuits, creditors, or irresponsible heirs, through various legal and financial strategies.

- Trust and Estate Planning: They assist in setting up trusts, wills, and other estate planning tools to ensure a smooth transfer of wealth according to the client's wishes.

- Tax Optimization: Multi-family offices help minimize tax liabilities by structuring investments and assets in a tax-efficient manner.

- Philanthropic Planning: They support families in establishing charitable foundations or trusts to leave a legacy of giving back to society.

Customized Approach in Legacy Planning

Multi-family offices take a personalized approach to legacy planning by understanding the family dynamics, values, and long-term objectives. They work closely with clients to develop comprehensive strategies that align with their unique circumstances and goals, ensuring a legacy that endures for generations to come.

Estate Planning Services Offered by Multi Family Offices

Estate planning services provided by multi-family offices play a crucial role in helping high-net-worth individuals and families manage their wealth and assets effectively for future generations

Comparison of Estate Planning Services

Multi-family offices offer a wide range of estate planning services that set them apart from traditional financial institutions. Unlike banks or standalone financial advisors, multi-family offices provide holistic and integrated solutions that cover not only financial aspects but also legal, tax, and personal considerations.

This comprehensive approach ensures that all aspects of estate planning are addressed cohesively, leading to a more robust and effective strategy for wealth transfer.

- Creation of wills and trusts: Multi-family offices assist clients in drafting legally sound wills and setting up various types of trusts to protect assets and minimize tax implications.

- Asset protection strategies: These offices help clients develop strategies to safeguard their wealth from creditors, lawsuits, and other risks that may jeopardize their legacy.

- Charitable giving and philanthropy: Multi-family offices work with clients to incorporate charitable giving into their estate plans, helping them leave a lasting impact on causes they care about.

- Succession planning for family businesses: They provide guidance on transitioning family businesses to the next generation, ensuring a smooth transfer of ownership and management.

Expertise and Specialization of Multi Family Offices

Multi-family offices bring a high level of expertise and specialization to estate planning due to their focus on serving affluent families. These offices typically have teams of professionals with backgrounds in law, finance, tax planning, and wealth management, allowing them to offer tailored solutions that address complex financial situations and unique family dynamics.

By leveraging their deep understanding of the intricacies of estate planning, multi-family offices can navigate the complexities of wealth transfer with precision and care.

Integration of Legacy and Estate Planning

Legacy and estate planning are two crucial aspects of financial planning that multi-family offices help their clients navigate. By integrating these two elements, multi-family offices ensure that their clients' wealth is preserved and their wishes are carried out effectively.

Successful Integration Examples

- Creating a comprehensive estate plan that includes provisions for passing down assets to future generations while also incorporating philanthropic goals.

- Establishing trusts that not only minimize estate taxes but also serve as vehicles for maintaining family values and legacy.

- Developing a succession plan for family-owned businesses that aligns with the overall estate and legacy planning objectives.

Long-Term Benefits of Alignment

- Ensures smooth transition of wealth and assets to the next generation, minimizing potential conflicts and legal issues.

- Preserves family values, traditions, and philanthropic goals for future generations to uphold.

- Maximizes the impact of wealth transfer by strategically utilizing various estate planning tools and techniques.

Closing Notes

As we conclude this discussion, it becomes evident that the integration of legacy and estate planning through the services of multi-family offices offers a comprehensive approach towards securing and transferring wealth across generations. The long-term benefits of this strategic alignment are truly invaluable.

General Inquiries

How do multi-family offices differ from traditional financial institutions in estate planning services?

Multi-family offices bring a specialized approach and expertise to estate planning that is tailored to high-net-worth individuals and their unique needs, whereas traditional financial institutions may offer more generalized services.

What are some common strategies employed by multi-family offices to preserve and transfer wealth?

Multi-family offices often utilize trust structures, family governance, and philanthropic initiatives to preserve and transfer wealth across generations while minimizing tax implications.

Why is legacy planning considered a crucial aspect of wealth management?

Legacy planning goes beyond traditional estate planning by focusing on values, aspirations, and non-financial assets, ensuring a meaningful transfer of wealth that reflects the individual's values and goals.