Exploring the intricate world of Money Wealth Management Techniques Used by Institutional Investors, this introduction sets the stage for a detailed and insightful discussion on how institutional investors navigate the complexities of managing wealth effectively.

The following paragraphs will delve into specific techniques, strategies, regulatory requirements, and innovative tools employed by institutional investors to optimize their wealth management practices.

Money Wealth Management Techniques Used by Institutional Investors

Money wealth management in the context of institutional investors involves the strategic allocation and preservation of assets to achieve financial goals and objectives. Institutional investors, such as pension funds, endowments, and insurance companies, employ various techniques to manage wealth effectively and mitigate risks.

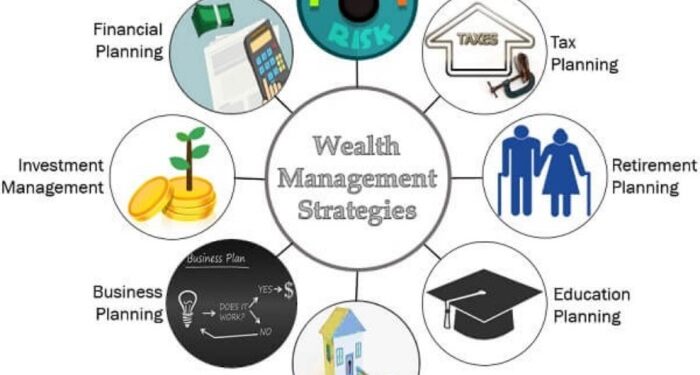

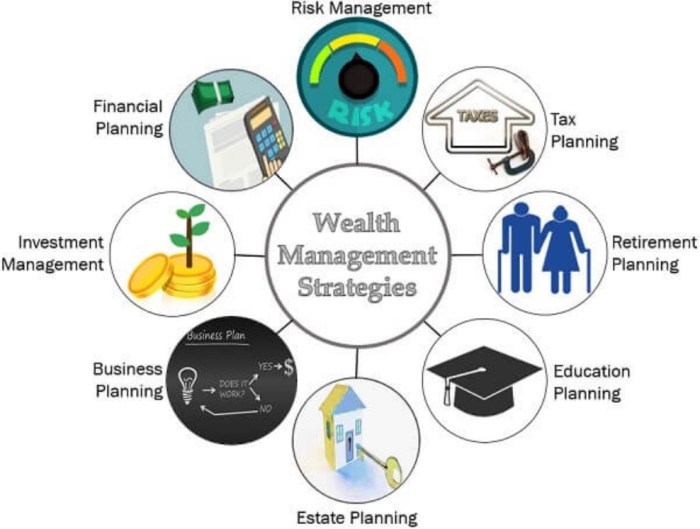

Specific Wealth Management Techniques

Institutional investors commonly use techniques such as asset allocation, portfolio diversification, and active management to optimize returns and minimize risks. Asset allocation involves spreading investments across different asset classes, such as stocks, bonds, and real estate, to achieve a balance between risk and return.

Portfolio diversification aims to reduce risk by investing in a variety of securities within each asset class. Active management involves making strategic investment decisions to outperform the market.

Diversification Strategies

Institutional investors utilize diversification strategies to manage wealth effectively by reducing the impact of market fluctuations on overall portfolio performance. By spreading investments across different sectors, industries, and geographic regions, institutional investors can minimize the risk of significant losses in any single investment.

Diversification helps to ensure a more stable and consistent return on investment over the long term.

Risk Management Importance

Risk management is a critical component of wealth management practices for institutional investors. By identifying and assessing risks associated with investments, institutional investors can implement strategies to mitigate potential losses and protect capital. Effective risk management involves setting risk tolerance levels, conducting thorough due diligence, and monitoring portfolio performance regularly.

Institutional investors prioritize risk management to safeguard wealth and achieve long-term financial success.

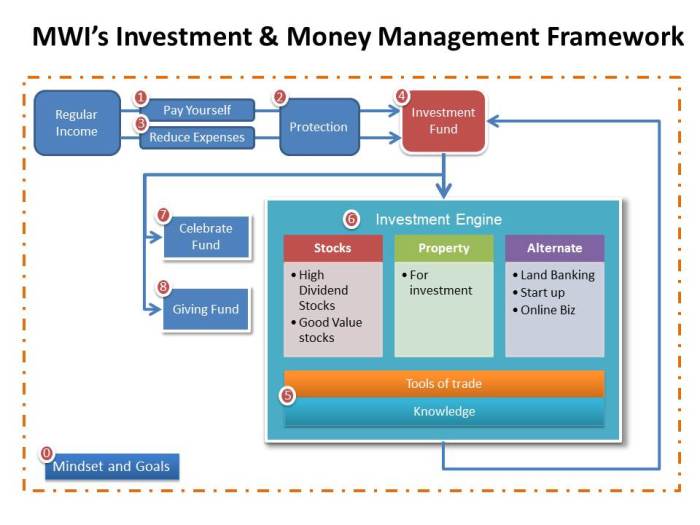

Investment Strategies

Investment strategies play a crucial role in the wealth management practices of institutional investors. These strategies help them achieve their financial goals, whether it be maximizing returns, managing risk, or preserving capital.

Value Investing, Growth Investing, and Index Investing

- Value investing focuses on finding undervalued stocks that have the potential for growth. Institutional investors look for companies with strong fundamentals trading below their intrinsic value.

- Growth investing, on the other hand, targets companies with high growth potential, even if they may be trading at a premium. Institutional investors seek companies with strong earnings growth and a competitive advantage in their industry.

- Index investing involves investing in a diversified portfolio that mirrors a specific market index, such as the S&P 500. Institutional investors use this strategy to achieve broad market exposure at a low cost.

Active and Passive Investment Strategies

- Active investment strategies involve frequent buying and selling of securities in an attempt to outperform the market. Institutional investors rely on research, analysis, and market timing to generate returns.

- Passive investment strategies, such as index investing, aim to replicate the performance of a specific market index. Institutional investors opt for passive strategies to reduce costs and maintain a long-term investment approach.

Asset Allocation Strategies

Asset allocation is a key component of wealth management for institutional investors. It involves distributing investments across different asset classes, such as stocks, bonds, and real estate, to optimize risk and return. Institutional investors use asset allocation strategies to diversify their portfolios and achieve their investment objectives.

Leverage and Margin Trading

Leverage and margin trading involve borrowing funds to amplify investment returns. Institutional investors use leverage cautiously to increase their exposure to certain assets or markets. While leverage can enhance returns, it also magnifies losses, making it a high-risk strategy.

Regulatory Compliance and Ethics

In the world of institutional wealth management, regulatory compliance and ethical considerations are paramount to ensure the integrity of the financial system and protect the interests of investors. Institutional investors are subject to a myriad of regulations and guidelines that govern their behavior and decision-making processes.

At the same time, ethical considerations play a crucial role in shaping the investment strategies and practices of institutional investors.

Regulatory Requirements for Institutional Investors

Institutional investors are required to comply with a wide range of regulations set forth by government agencies and regulatory bodies. These regulations are designed to ensure transparency, fairness, and accountability in the financial markets. Some of the key regulatory requirements that institutional investors must adhere to include:

- Reporting and disclosure requirements to provide investors with accurate and timely information about their investments.

- Compliance with anti-money laundering (AML) and know your customer (KYC) regulations to prevent illicit activities and safeguard the financial system.

- Adherence to fiduciary duties to act in the best interests of their clients and avoid conflicts of interest.

Ethical Considerations in Wealth Management

Ethical considerations are at the core of institutional investors' decision-making processes. Institutional investors are expected to uphold high ethical standards and conduct themselves with integrity and honesty. Some of the ethical principles that guide institutional investors include:

- Putting the interests of clients first and prioritizing their financial well-being.

- Avoiding insider trading and other unethical practices that could harm the integrity of the financial markets.

- Respecting the rights of stakeholders and engaging in socially responsible investing practices.

Ethical Dilemmas in Wealth Management

In the course of managing wealth, institutional investors may encounter ethical dilemmas that require careful consideration and ethical judgment. Some examples of ethical dilemmas that institutional investors may face include:

- Deciding whether to disclose sensitive information to clients that could impact their investment decisions.

- Balancing the pursuit of profits with the need to uphold ethical principles and social responsibility.

- Managing conflicts of interest that may arise in complex financial transactions.

Importance of Transparency and Accountability

Transparency and accountability are essential principles in wealth management practices for institutional investors. By being transparent about their investment strategies and decisions, institutional investors can build trust with clients and stakeholders. Accountability ensures that institutional investors are held responsible for their actions and decisions, creating a culture of integrity and ethical behavior in the financial industry.

Technology and Innovation in Wealth Management

Technology plays a crucial role in enhancing wealth management for institutional investors. From artificial intelligence to blockchain, innovative tools and platforms are revolutionizing the way wealth is managed in today's digital age. Let's explore the impact of technology on wealth management strategies.

Role of Artificial Intelligence and Blockchain

Artificial intelligence (AI) and blockchain technology have transformed the way institutional investors manage their wealth. AI-powered algorithms can analyze vast amounts of data to identify trends and patterns, helping investors make informed decisions. Blockchain, on the other hand, ensures secure and transparent transactions, reducing the risk of fraud.

Robo-Advisors and Automated Trading Systems

Robo-advisors and automated trading systems have become increasingly popular among institutional investors. These platforms use algorithms to provide investment advice and execute trades without human intervention. This automated approach allows investors to react quickly to market changes and optimize their portfolios efficiently.

Innovative Tools and Platforms

Institutional investors are leveraging innovative tools and platforms to streamline wealth management processes. For example, portfolio management software offers real-time updates on asset performance and risk exposure, enabling investors to make timely adjustments to their investment strategies. Additionally, digital wealth management platforms provide a user-friendly interface for investors to monitor their portfolios and track their financial goals.

Data Analytics and Predictive Modeling

Data analytics and predictive modeling are essential tools utilized by institutional investors to make informed investment decisions. By analyzing historical data and market trends, investors can predict future outcomes and optimize their investment strategies. These analytical tools help investors identify opportunities and mitigate risks in a dynamic market environment.

Wrap-Up

In conclusion, the discussion on Money Wealth Management Techniques Used by Institutional Investors sheds light on the diverse strategies and considerations that shape the financial landscape for institutional investors. It highlights the importance of adaptability, transparency, and ethical decision-making in the realm of wealth management for institutional investors.

Essential Questionnaire

What are some common wealth management techniques used by institutional investors?

Institutional investors often utilize diversification, asset allocation, and risk management strategies to effectively manage wealth.

How do institutional investors approach regulatory compliance in wealth management?

Institutional investors must adhere to strict regulatory requirements to ensure legal and ethical wealth management practices.

What role does technology play in enhancing wealth management for institutional investors?

Technology such as artificial intelligence, blockchain, and data analytics are employed to streamline wealth management processes and make informed investment decisions.

How do institutional investors address ethical dilemmas in wealth management?

Institutional investors consider ethical considerations and transparency to navigate potential dilemmas and make responsible decisions in wealth management.